Optical character recognition, or OCR, is an invaluable technology that has seen major improvements in recent years. One industry that frequently relies on this technology is insurance. OCR in insurance helps digitize paper documents and automate data collection.

Although much of the work has moved online, insurance companies in the US and many other parts of the world, work with forms and documents. As regulations get tougher and processes become more complex, it only makes sense to have tools that quickly scan and extract information from these documents.

This article will explore OCR’s role in the insurance industry and how businesses can use it to streamline their processes, comply with regulations, and deliver a great customer experience. We’ll also discuss MST, a document management solution, and its OCR software.

What is OCR and How Does it Work in Insurance?

Optical character recognition (OCR) is a technology that scans text from handwritten or printed documents or images, extracts text from them, and turns it into a digital document. For instance, it can take the scan of a handwritten note, recognize the text in it, and produce a PDF document with the exact text. This technology eliminates the need to manually type a document in paper format.

To understand how OCR works in insurance, it’s best to understand the mechanisms behind the technology.

The process begins using an image of the document, either from a fax machine, camera or scanner. The image is then optimized and improved with using filters and other digital manipulation tools. The OCR software then locates text in the image, either areas or blocks of text. Then, the character recognition algorithm comes into action, recognizing each character individually. Most OCR software uses pattern matching for character recognition. It matches the individual characters and their patterns with an existing database. Some advanced solutions can also recognize the font, size, and style of the printed characters/words. Finally, the software processes the text to find errors and correct them.

This technology has various use cases in insurance. From processing claim forms to comparing documents, OCR is used in many document-centric workflows in insurance companies.

MST’s document solution includes built-in OCR software that helps automate data extraction from images of printed or handwritten documents. The software can turn these documents into digital, editable, and searchable files, making it easy for insurance workers to do their jobs.

Benefits of OCR for the Insurance Industry

OCR in insurance offers several benefits. Let’s zero in on all of them:

- Automation and Efficiency: Manual data collection is still a big hurdle in the insurance industry. A survey shows 65% of life insurers believe manual processes slow down their work. That’s where automation solutions like OCR come in. There’s still some human involvement, as a worker would need to scan the documents and work with the software, but the overall process speeds up significantly. There’s no need to look at a document and type in the text manually.

- Improved Accuracy and Reduced Errors: OCR minimizes errors in document processing, ensuring higher accuracy, reducing delays, and improving customer satisfaction. Manual data entry is prone to human errors, which can be costly for an insurer. For instance, a payout may end up being higher. Since competition is so tough in insurance, there’s no room for errors that cost money. Plus, accuracy is also essential from a compliance point of view (more on that later).

- Cost Reduction: Automating document workflows allows insurance companies to cut operational costs. It frees employees to focus on higher-value tasks, such as customer support and policy development. The overall manpower used in workflows like document verification and claims processing can be reduced. In other words, investing in an OCR solution pays for itself.

- Regulatory Compliance: OCR helps insurance companies meet U.S. regulatory requirements like HIPAA (Health Insurance Portability and Accountability Act), NAIC (National Association of Insurance Commissioners) standards, and state-specific insurance regulations by ensuring data accuracy, security, and audibility. By digitizing documents accurately, insurers ensure their clients’ information is protected. A compromised paper document (or even a digital one) may lead to heavy fines and bad publicity.

- Data Accessibility and Integration: OCR makes unstructured data in paper documents searchable and easier to integrate with insurance systems, such as policy and customer relationship management systems. This way, data from documents can be moved seamlessly into other systems for processing and storage.

Key Applications of OCR in Insurance

While OCR’s use cases may vary by insurer type, almost the entire industry can use this technology. Many insurance businesses still rely on paper-based documents. Some may even be working with hand-filled forms. All those documents must be processed digitally, which is where OCR comes in handy.

Here are specific OCR use cases within the U.S. insurance sector:

- Claims Processing: OCR for insurance claims automates data extraction from claim forms, accident reports, and medical records, speeding up claims validation and processing. Whether customers mail in the forms or submit them online, the images of the forms can be quickly scanned for relevant information and fed into the system for processing. It can also make the claims adjuster’s job easier by giving them access to a digitized copy of the form or as object data in whatever system they use.

- Policy Management: OCR helps insurers digitize and manage policy documents. This ensures that records are accurate, searchable, and easily accessible for audits or renewals. It may also help create digital archives of old policies. The digitized text of the policy can easily be accessed by tools to verify information and make decisions on claims.

- Underwriting and Risk Assessment: OCR simplifies the underwriting process by digitizing and analyzing customer data. An underwriter evaluates the risks involved in insuring people or assets. So, they have to assess and analyze financial documents, which may be in printed format. OCR digitizes these documents and reduces the time needed to assess risks and issue policies. As a result, insurers can offer their customers quick assessments and policy quotes.

- Fraud Detection: OCR allows insurance companies to analyze historical claims data and spot anomalies that could indicate fraudulent activity. Similarly, they can verify the authenticity of supporting documents, such as financial statements, state-issued IDs, and property appraisals.

- Customer Onboarding: OCR simplifies document processing during customer onboarding by automatically extracting information from identification documents and application forms. For example, people signing up in retail locations of insurance companies may fill out forms in their handwriting. Thanks to OCR technology, those forms can easily be scanned and data extracted from them.

The Role of OCR in Regulatory Compliance for Insurance Companies

Insurance companies are heavily regulated. Depending on where they do business, they may need to comply with finance, data protection, and privacy-related regulations. Some of these regulations apply at a federal level in the US, meaning every company has to comply. On the other hand, some may be more state-specific.

Let’s look at some standard regulations insurers must comply with and how OCR helps with that.

- HIPAA Compliance: HIPAA, Health Insurance Portability and Accountability Act of 1996, is a U.S. federal law that sets standards for the privacy and security of personal health information. Health insurance companies are also liable to comply with this regulation as they routinely handle patient’s sensitive data, including personal and medical information. OCR ensures that insurers handling health insurance claims comply with HIPAA by securely digitizing and storing sensitive medical records and customer data on secure internal servers/private clouds.

- NAIC Model Regulations: The NAIC (National Association of Insurance Commissioners) model laws and regulations provide a framework for insurance companies to follow. These models help ensure consistency and uniformity across different states, making it easier for insurers to operate nationwide.OCR streamlines the compliance process with the NAIC model. Insurers can digitize claims records and customer policies, making auditing and tracing documents with sensitive information easier.

- Fraud Prevention Standards: OCR enhances insurance companies’ ability to detect and prevent fraudulent claims by digitizing and analyzing large volumes of claims data. This technology can work alongside fraud detection software designed to detect irregularities in documents. It can also work with verification software that verifies the veracity of information, such as IDs and financial statements.

- State-Specific Insurance Regulations: U.S. insurers face different state regulations. For instance, in California, insurers must comply with the California Consumer Privacy Act (CCPA). The CCPA law gives California residents more control over their personal information, including the right to know what data is collected, delete their data, and opt out of the sale of their personal information. While OCR doesn’t directly ensure compliance with such standards, it can help ensure it by securing personally identifiable information of insurance buyers. Any sensitive data in paper documents can be digitized and saved as digital files on secure servers, and any paper trail may be destroyed.

Emerging Trends in OCR Technology for Insurance

OCR has come a long way since its inception, which, interestingly, was to help the blind read. Thanks to advancements in camera technology, image processing, and machine learning, OCR is poised to transform even more.

Here are some OCR trends we’ll also see adopted in the insurance industry (at least by companies that want to stay updated with the latest technologies).

- AI-Powered OCR: AI integration allows for smarter, context-aware OCR systems that improve data extraction. Thanks to algorithms that have trained on large language models (LLMs), AI-based OCR tools can even extract information from complex documents or those that are not high quality. What’s the game changer is context. Such tools can gauge what kind of document it is and what industry or purpose it may serve.

- Cloud-Based OCR: Cloud-based OCR solutions offer U.S. insurance companies scalable, secure document processing that complies with federal and state data privacy regulations. With cloud-based OCR software, employees can scan, process, and extract data from documents anywhere. They may be able to use the tool on their browsers or even mobile devices.

- Mobile OCR for Insurance Agents: Mobile OCR capabilities allow insurance agents and adjusters to capture and process documents remotely. They can easily do so with an app on their phone. For example, they can upload an image of a form or document. Even the native camera apps on the latest smartphones have a basic version of OCR. It’s easy to copy and paste text from an image and create a document. However, for proper use, a dedicated OCR mobile solution is necessary.

How MST’s OCR Solutions Help Insurance Companies

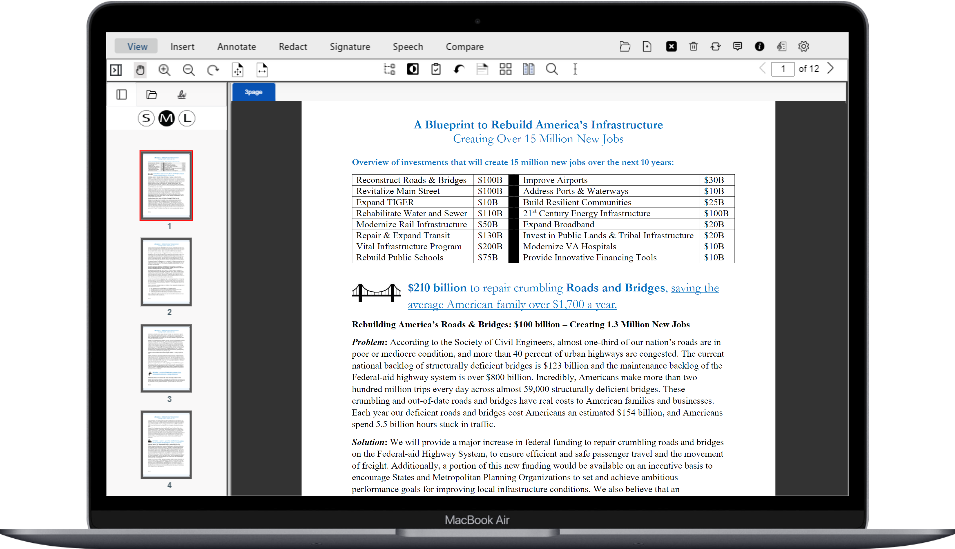

One of the best US insurance OCR solutions is MST’s eViewer. An all-inclusive document viewing and sharing solution comes with native OCR software. Designed to make it easy to digitize paper documents and images, it works with scanners to capture digital images and turn them into editable and searchable digital files. It can even retain the same formatting for most documents.

The tool can easily fit into insurance workflows like claim processing or underwriting, taking information from documents and feeding it to internal systems. That’s all possible with the help of APIs. With APIs, insurers can integrate eViewer with existing systems, so information flows automatically with minimal human intervention.

That’s not all—MST’s OCR solution is also super fast. MST moves the processing workload to the local device, freeing up the server’s computing capacity. Plus, it’s designed with a compliance-first approach, making it easier for insurance companies to comply with regulations.

With digitized documents having proper usage trails, it’s easy to audit them and increase accountability.

Conclusion

The US insurance industry is worth trillions and has many big and small players. To beat the competition in this industry, it all comes down to operational efficiencies and good customer service. And that’s precisely what technologies like OCR ensure. With OCR automation, insurers can extract information from paper-based documents and streamline key workflows like claims processing, policy formulation, and verification. Plus, OCR also aids with insurance regulatory compliance by digitizing documents.

MST’s OCR solution is an advanced tool for document-centric industries, including insurance. It’s an easy-to-use software that requires minimal training and works with multiple platforms. Moreover, it can easily be integrated into the company’s tech stack.

Interested in learning more? Contact MST today and see what its technologies can do for your insurance business.

Used and Trusted by Thousands of Innovative Start-ups, Governments, and Fortune 1000 businesses Worldwide to Power their Products and Services

Get Started

Join countless businesses that have transformed their operations with our game-changing OCR software – where text meets transformation!